Let’s dig into why this is the case. First off, paper wallets are a fortress of security in a world full of digital vulnerabilities. Unlike digital wallets, which can be susceptible to hacks or software glitches, paper wallets are immune to online threats. They’re offline, stored in a physical form that can’t be easily tampered with from a distance. Imagine having a vault that’s impervious to digital break-ins—that’s what a paper wallet offers.

Moreover, for those who prioritize privacy, paper wallets are a gem. Digital wallets often require personal data, which can be a concern for privacy advocates. With a paper wallet, you’re not sharing sensitive information online; it’s all kept in your hands, away from prying eyes.

Then there’s the appeal of simplicity. Paper wallets are incredibly straightforward—print a key, store it somewhere safe, and you’re done. No need to worry about software updates or compatibility issues. It’s like keeping your cash under the mattress versus relying on a high-tech safe.

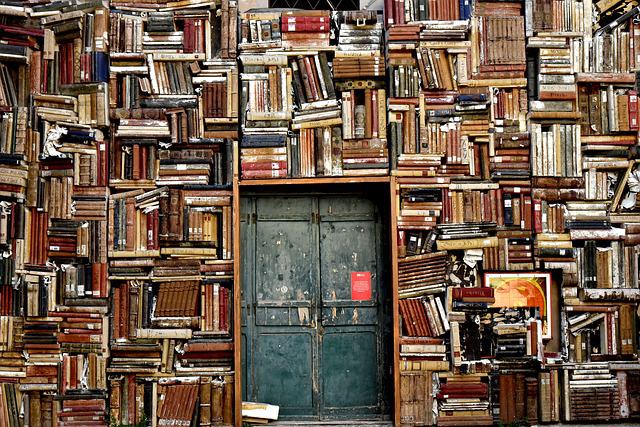

Let’s not forget about the tangible aspect. There’s something reassuring about holding a physical item that represents your assets. It’s a bit like having a physical book in the digital age; the tactile experience can’t be replaced by pixels on a screen.

In summary, while digital wallets have their advantages, paper wallets remain relevant due to their unmatched security, privacy, simplicity, and the comfort of having something you can physically hold and store safely.

Paper Wallets: The Enduring Appeal of Tangible Security in a Digital World

In simple terms, a paper wallet is a physical document that stores cryptocurrency keys offline. This “offline” aspect is its secret weapon. Picture it like a treasure chest hidden in a vault, untouched by the chaotic currents of the online world. As a result, it becomes impervious to hacking, phishing, and other digital threats that often plague online wallets.

Why does this low-tech approach still hold such a magnetic pull? For many, it’s about peace of mind. The idea that your assets are safely stored on a piece of paper, far removed from the vulnerabilities of the internet, is reassuring. It's like putting your money in a safe deposit box rather than leaving it under the mattress.

Creating a paper wallet is a straightforward process. You generate the keys offline, print them out, and store the printout securely. The beauty of this method is that the paper itself doesn't interact with the internet, so the keys it holds are free from the usual digital risks. It's an approach that might seem old-fashioned, but it’s this very simplicity and detachment from the digital realm that make it a robust choice for those prioritizing security.

Despite the advancement of technology, the charm of paper wallets lies in their timeless security. Just like the old-school safes that guard physical valuables, these paper-based solutions continue to offer a reliable fortress against digital threats, proving that sometimes, the old ways are still the best.

Why Paper Wallets Remain a Key Player in the Digital Payment Era

Imagine a paper wallet as a physical, unhackable vault for your digital assets. It's essentially a piece of paper that holds your cryptocurrency's private keys. Unlike online wallets or exchanges that could be vulnerable to cyber-attacks, a paper wallet is immune to hacking because it's offline. Think of it as storing your valuables in a safe deposit box at a bank versus keeping them in your home, where they might be exposed to risk.

Paper wallets are also incredibly straightforward. You don't need to understand complicated software or worry about digital security updates. All you need is a printer and a bit of careful handling. This simplicity makes paper wallets a great option for those who prefer a hands-on approach or who aren't comfortable navigating complex tech solutions.

Moreover, paper wallets are an excellent way to ensure long-term storage. If you're holding onto digital assets for future use, a paper wallet can be stashed away safely, free from the constant threat of digital obsolescence. Just like an old-fashioned savings bond, a paper wallet doesn't require any ongoing maintenance or monitoring.

So, even as digital payments and cryptocurrencies continue to evolve, paper wallets remain a vital tool in the toolkit. They provide a reliable, low-tech option for safeguarding your digital wealth, proving that sometimes, the old ways are still the best ways.

Digital vs. Paper Wallets: Why Old-School Security Still Matters

Digital wallets are sleek and convenient, offering instant access to your funds with just a tap or click. They store your private keys electronically, making transactions smooth and effortless. However, this digital convenience comes with its own set of risks, like hacking and malware attacks. Picture your digital wallet as a shiny new car parked in a crowded street—it’s easy for thieves to target if they know what they’re looking for.

On the flip side, paper wallets represent a classic approach to security. Imagine them as a vault in your basement—secure, offline, and out of reach from digital threats. A paper wallet involves printing out your private and public keys on paper. Since it’s not connected to the internet, it’s virtually immune to hacking. It’s like keeping your valuables in a safe deposit box at a bank rather than under your pillow.

But, don’t get too cozy just yet. Paper wallets come with their own set of challenges. They can be lost, damaged, or destroyed—think of it as your safe deposit box being accidentally thrown out with the trash. Also, they require careful handling; if someone gets their hands on your paper wallet, they have access to your assets.

So, while digital wallets offer convenience and speed, paper wallets offer an added layer of security that’s hard to match in the digital realm. It’s a classic case of old-school methods providing a dependable backup in an age where cyber threats are ever-present.

The Resilient Paper Wallet: Why Some Users Still Prefer Paper Over Pixels

Imagine your digital assets as a high-stakes poker game. If you're sitting at the table, it's like having your chips in a digital wallet—quick, convenient, but also exposed to the risk of a bad beat. Paper wallets, on the other hand, are akin to stashing your chips in a safe deposit box. They're offline, meaning they're immune to online hacks and cyber threats.

But it’s not just about safety. Paper wallets offer a sense of tangibility that digital options simply can’t provide. It’s like holding a vintage vinyl record; there's something undeniably satisfying about physically owning and handling it. With a paper wallet, you have a tangible backup of your digital assets. It's also an excellent way to safeguard your investments from power outages, software glitches, or if you simply prefer a break from screens.

Paper wallets can be a bit finicky to use, sure. You have to handle them with care, and you need to ensure you’re printing and storing them securely. But for many, the peace of mind that comes with having their assets offline outweighs the inconvenience.

So, while pixels and digital storage are great, paper wallets offer a refreshing dose of old-school security. They provide a sense of permanence and safety that digital solutions, with all their advancements, can sometimes lack. In a world obsessed with the latest tech trends, it's this blend of security and nostalgia that keeps paper wallets relevant.